Where Private Markets

Meet Digital Innovation

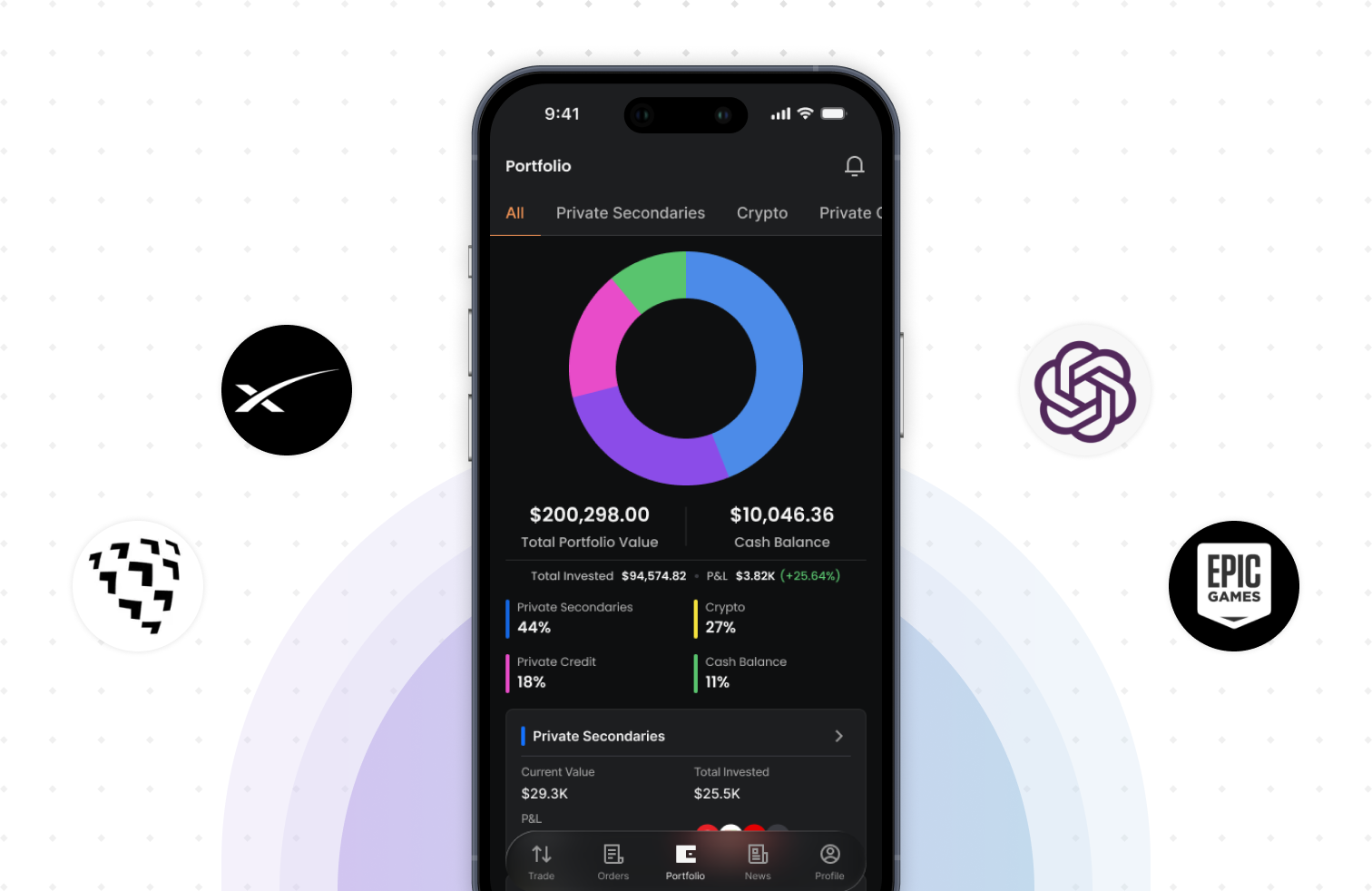

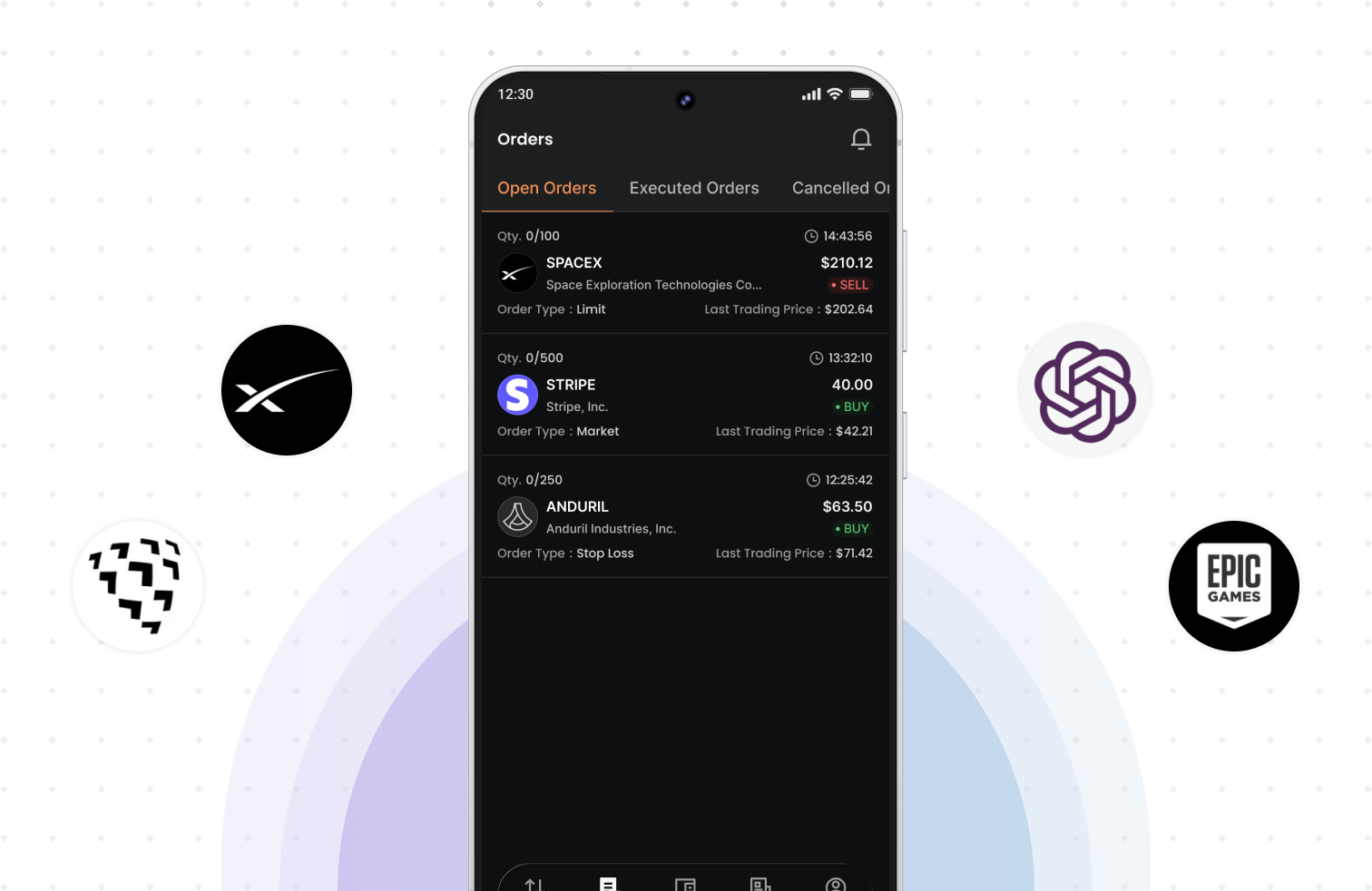

Designing a unified trading experience for private equity, cryptocurrency, and private credit, making complex investments accessible.

Reimagining alternative investments for the digital age

This project focused on designing a unified trading platform for private equity, cryptocurrency, and private credit, spanning Web, iOS, and Android. The challenge was creating a seamless, secure, and intuitive experience for users navigating complex financial markets.

Alternative investments have traditionally been accessible only to institutional investors and high-net-worth individuals. Our mission was to democratize access while maintaining the sophisticated tools and security that this market demands.

The details at a glance

What we set out to achieve

Design a trading platform that makes complex alternative investments accessible, understandable, and trustworthy for a new generation of investors.

The platform needed to bridge the gap between traditional finance complexity and modern user expectations. Users should feel confident making significant investment decisions without needing a finance degree to understand the interface.

My contributions to the project

-

1

End-to-End Product Design Led the complete design process from research to final handoff across all platforms

-

2

Design System Architecture Created a comprehensive design system ensuring consistency across web and mobile

-

3

User Research & Testing Conducted user interviews, usability testing, and iterative validation

-

4

Stakeholder Management Facilitated design reviews and aligned cross-functional teams on product vision

-

5

Interactive Prototyping Built high-fidelity prototypes for complex trading flows and animations

Aligning design with business objectives

Expand Market Reach

Enable accredited investors to easily access alternative investment opportunities that were previously limited to institutional players.

Reduce Friction

Streamline the investment process from discovery to execution, reducing time-to-trade by 60% compared to traditional methods.

Build Trust

Establish credibility through transparent information architecture, security indicators, and regulatory compliance visibility.

Understanding the problem space

We conducted extensive research to understand both novice and experienced investors. The discovery phase revealed critical insights about trust, complexity, and decision-making in alternative investments.

Key Research Methods

-

→

User Interviews 20+ interviews with target users

-

→

Competitive Analysis Analyzed 12 competing platforms

-

→

Journey Mapping Mapped end-to-end investment flows

From insights to solutions

The ideation phase focused on creating intuitive interfaces for complex alternative investments. We explored approaches to unify private equity deal flow, crypto portfolio tracking, and private credit opportunity analysis into a cohesive investment experience.

Unified Asset Views

A single dashboard consolidating PE holdings, crypto wallets, and private credit positions for holistic portfolio oversight.

Real-Time Market Intelligence

Live crypto valuations, PE fund updates, and credit market trends integrated with contextual analysis.

Institutional-Grade Security

Multi-signature custody, regulatory compliance badges, and audit trails built for institutional investors.

Bringing the vision to life

Impact and results

The platform launched successfully across all three platforms, receiving positive feedback from both users and stakeholders. The design system we created has since been adopted as the foundation for other products in the company's portfolio.

What this project taught me

Trust in financial products is earned through every micro-interaction, not just security badges.

This project reinforced the importance of understanding domain complexity before attempting to simplify it. Working closely with compliance teams, financial advisors, and actual investors provided insights that no amount of secondary research could have revealed.

The biggest breakthrough came from recognizing that our users didn't want less information; they wanted information designed with better hierarchy. By layering data and providing contextual tooltips, we made the complex feel simple.thout hiding it.